Recently, I started publishing videos on Instagram and TikTok where I explain cloud computing. It’s important to have some knowledge of the market, and this content was created as a deeper dive into topics that are hard to cover in just two minutes.

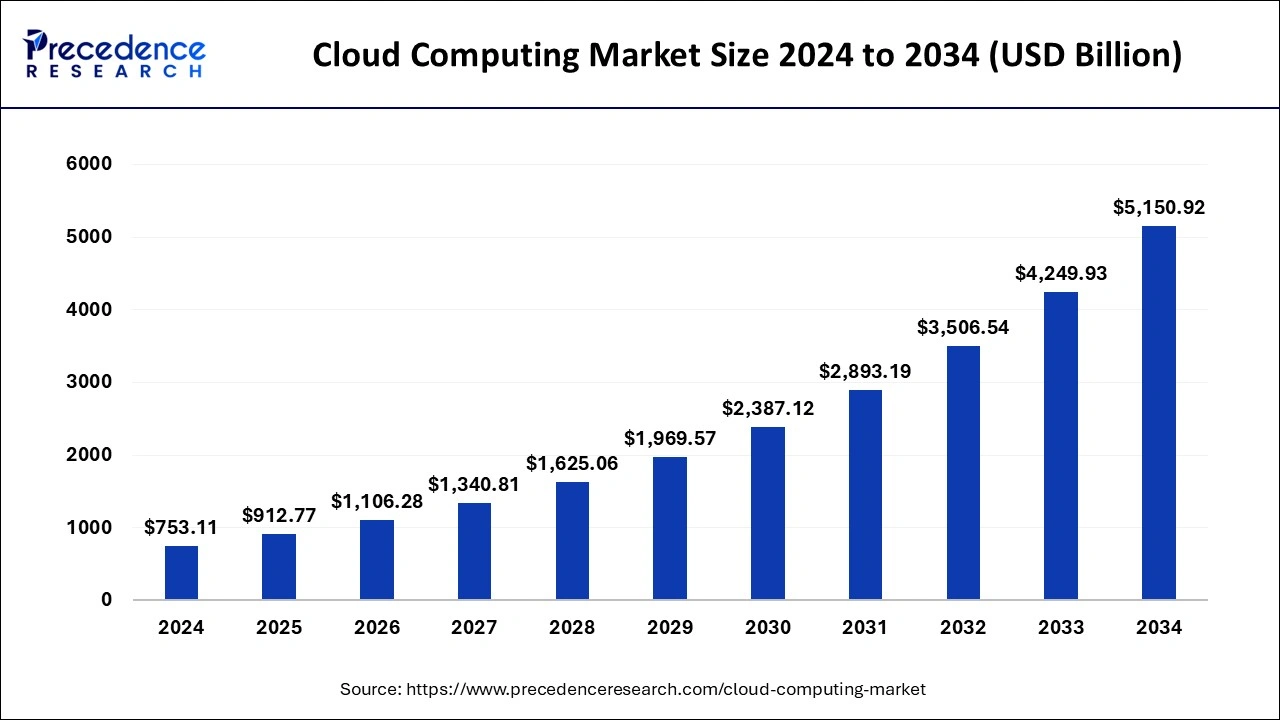

The global cloud computing market in 2024 is worth over USD 753 billion and is expected to exceed USD 2 trillion by 2030, thanks to a compound growth rate of 21-22%. Companies like Precedence Research and Goldman Sachs report nearly identical numbers.

Synergy Research Group, on the other hand, excludes the SaaS component in its research and includes only IaaS, PaaS, and hosted private cloud (cloud solutions dedicated to a single organization but hosted on a provider’s servers). This way, we exclude ready-to-use software like Salesforce and Adobe products and focus instead on the demand and supply from those who choose the cloud to build their own infrastructure. In other words, we look at the market of so-called hyperscalers, which is worth USD 330 billion in 2024.

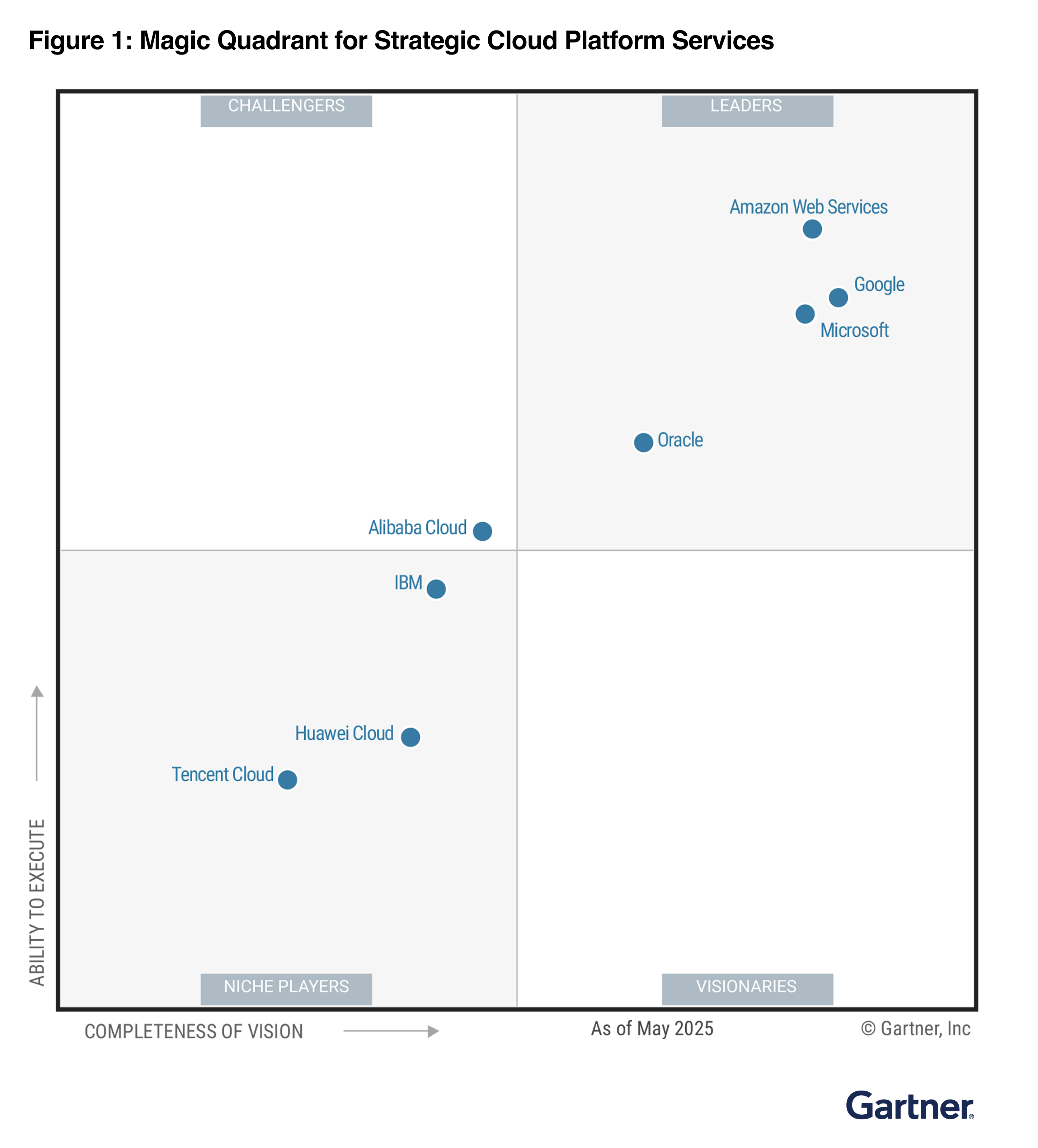

Who are the major players? Anyone working with the cloud can probably guess the key actors: Amazon holds 30% of the market share, followed by Microsoft and Google with 20% and 13%, respectively, gradually closing the gap. These are what Gartner labels as Leaders. Using its Magic Quadrant, Gartner identifies those in the top quadrants as having the highest execution capabilities and those on the right quadrants as having the strongest vision. Thus, the top-right quadrant—where the “magnificent three” are—represents companies excelling in both aspects: the leaders. The bottom-left quadrant, conversely, contains the weaker players.

You may notice a fourth player in the top quadrant. Indeed, since 2023, Gartner recognizes Oracle as a leader, even though it holds only 2% of the market share, thanks to its AI services.

We’ve named some players; now let’s look at the market geographically. The four top leaders are American, so it’s no surprise that the U.S. represents the largest and most developed market, with 23% growth in Q4. However, the Asia-Pacific region is growing the fastest, driven mainly by Alibaba Cloud, which Gartner labels as a Challenger: strong execution but less impressive vision.

It should be noted, however, that the Asian market is fairly closed for geopolitical reasons, so American providers don’t have easy access. For example, AWS is present in China, but its infrastructure is on a separate tenant, and the provider can operate only through authorized local partners.

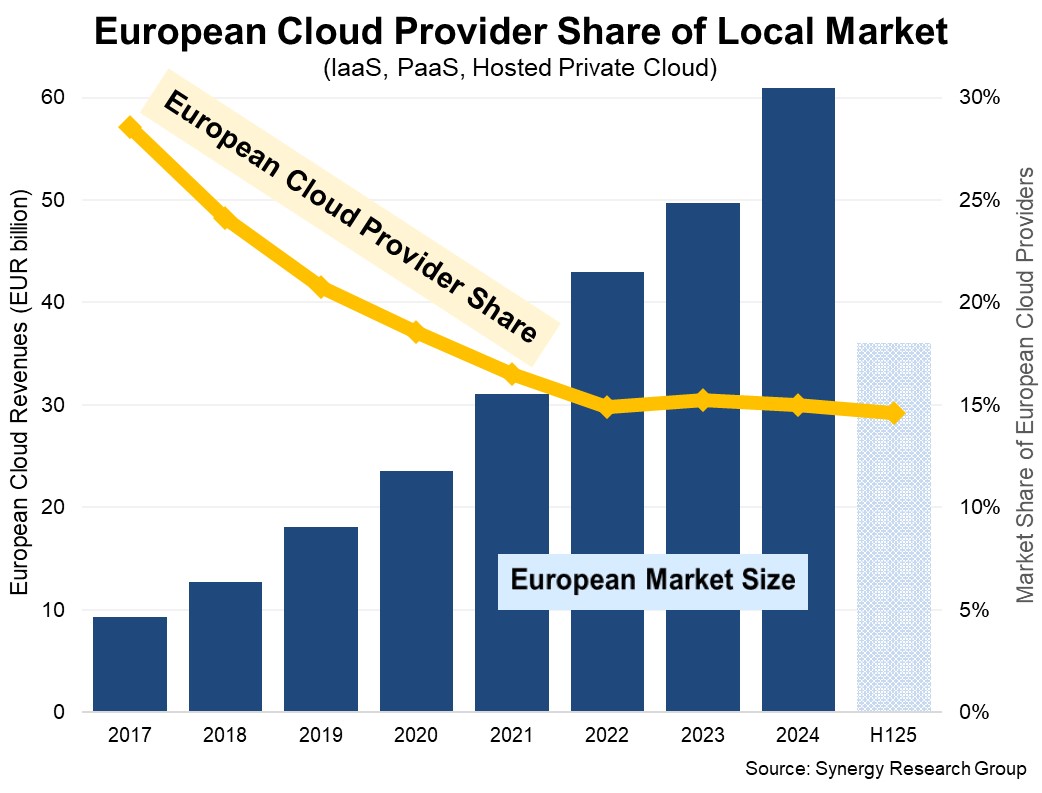

Europe, unfortunately, tells a sad story. The cloud market itself is growing significantly. The UK and Germany are the most developed areas, but the providers benefiting from this growth are still the American leaders, who control 70% of the European market. European providers hold almost negligible shares. The largest are the German SAP and Deutsche Telekom, with 2% of the European market, followed by the French OVH and Telecom Italia. Their market share dropped from 29% in 2017 to a stagnant 15% since 2022.

Honestly, this doesn’t surprise me. This was precisely the time when I moved away from identical VPSs offered by European providers—often coupled with terrible customer support—and discovered cloud computing for the first time, becoming fascinated by AWS’s incredibly innovative services.

Italy is behind, no point hiding it. The providers are so niche that there isn’t even data on market share. If we want to find a silver lining, Italy ranks among the countries with the highest growth rates, both in Europe—along with Spain and Ireland—and globally—alongside Brazil, India, and Japan.

In short, in case there were any doubts, U.S. dominance is clear. AI has given cloud computing growth a boost since the advent of ChatGPT. The impression is that the U.S. is setting the rules of the game once again, regardless of the bubble that markets are currently inflating.

Resources:

- Synergy Research Group: Cloud Market Jumped to $330 billion in 2024

- Synergy Research Group: European Cloud Providers’ Local Market Share

- Precedence Research: Cloud Computing Market Size, Share, and Trends 2025 to 2034

- Goldman Sachs: Cloud revenues poised to reach $2 trillion by 2030 amid AI rollout

- Mordor Intelligence: Cloud Computing Market